Brisbane Property Offers Extreme Value

“Brisbane offers compelling value in absolute and relative terms. Historic underperformance has sown the seeds for Brisbane's future outperformance.”

David Moore

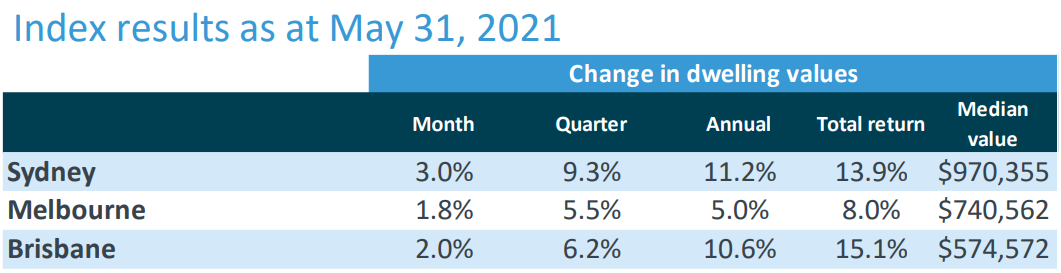

Sydney’s median dwelling price is 69% higher than Brisbane’s. Melbourne’s median dwelling price is 29% higher than Brisbane’s. No wonder the great northern migration has begun in earnest!

Since the bottom of the last property cycle in March 2009, Sydney residential property prices are up 131%, Melbourne is up 126% and Brisbane is up 95% (ABS, CoreLogic). Brisbane has lagged significantly.

The following reasons explain this historic under-performance::

2010-11 floods - as property markets began to recover from their March 2009 lows in the aftermath of the GFC, Brisbane was smashed by historic floods, with property damage estimated at $2.4 billion. The impact on Brisbane property prices was of a similar magnitude to that resulting from the GFC, with prices falling about 5%.

2014-15 mining bust – as property markets elsewhere roared to life, Brisbane dealt with the end of the mining boom as the coal price collapsed.

2014-15 lending restrictions – as property prices rose strongly, most notably in Sydney, APRA made a pre-emptive strike against banks taking excessive risk by introducing macro-prudential controls to ration credit and reduce investor participation. Of course, these were blunt policies that did not discriminate by location, putting an artificial handbrake on Brisbane property prices, just as it did in other markets.

2017-19 Banking Royal Commission – whilst APRA’s controls made it harder to get a loan and curbed investor enthusiasm, the royal commission had the banks running scared. Even prime borrowers found it difficult to get a loan, and approval timeframes pushed out. Between Jun17 and Jun19, property prices fell in Sydney, Melbourne and Brisbane. It was another intervention restraining market forces.

2020 COVID – just as property prices began recovering in late 2019 and early 2020, they took another hit from COVID, although the price falls were small relative to some dire predictions made in various quarters.

The flood, mining bust, lending restrictions, royal commission, and COVID mean the Brisbane property market has not had a good run since emerging from the GFC in 2009.

This historic underperformance has sown the seeds for Brisbane's future outperformance — as the national market finds its equilibrium.

Brisbane offers compelling value in absolute and relative terms.

Subdued price growth and lower interest rates combined to make Brisbane property the most affordable it had been for 20 years late last year. This rally is in its early stages. And with lower median prices, higher rental yields, transformative infrastructure investment, and high interstate migration from its larger southern neighbours, Brisbane price growth is likely to be materially higher than that enjoyed by Sydney and Melbourne over the balance of this cycle.

Get in touch to discuss how you can best take advantage of the Brisbane boom.